Dr Syed S. Kazi

For decades, India’s Non-Governmental Organisations (NGO) landscape has pulsated with countless dedicated organizations tackling diverse challenges, from healthcare and education to environmental conservation. Yet, despite their unwavering efforts, fundraising often remains a daunting obstacle, particularly for smaller and emerging NGOs. This is where the Securities and Exchange Board of India’s (SEBI) Social Stock Exchange (SSE) is seen as a beacon of hope, offering a transformative approach to NGO fundraising.

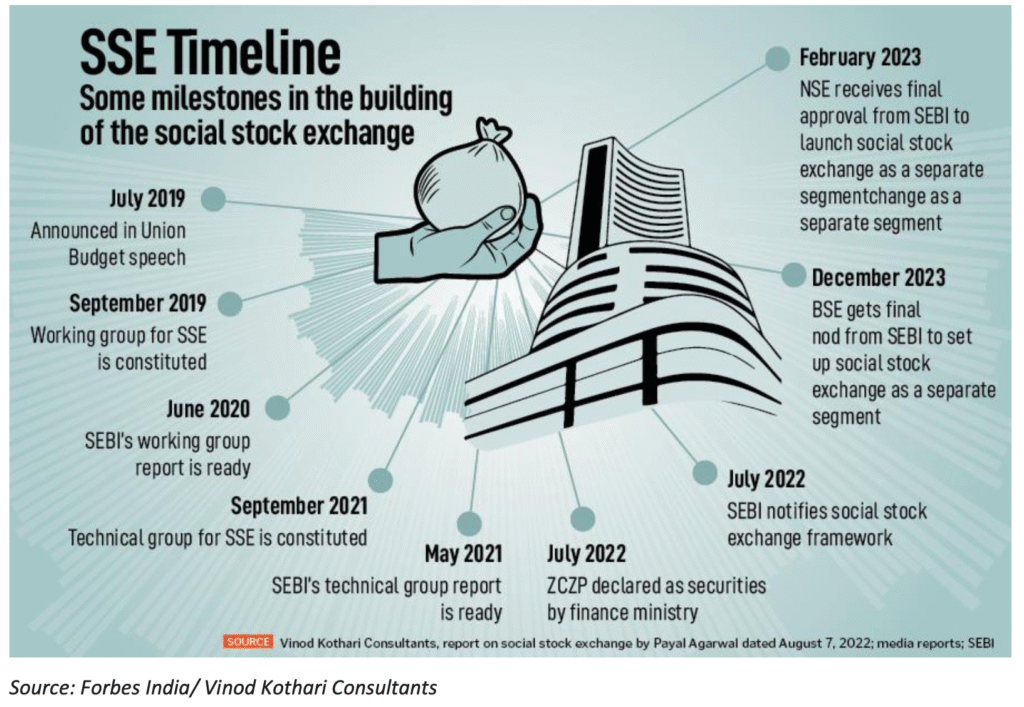

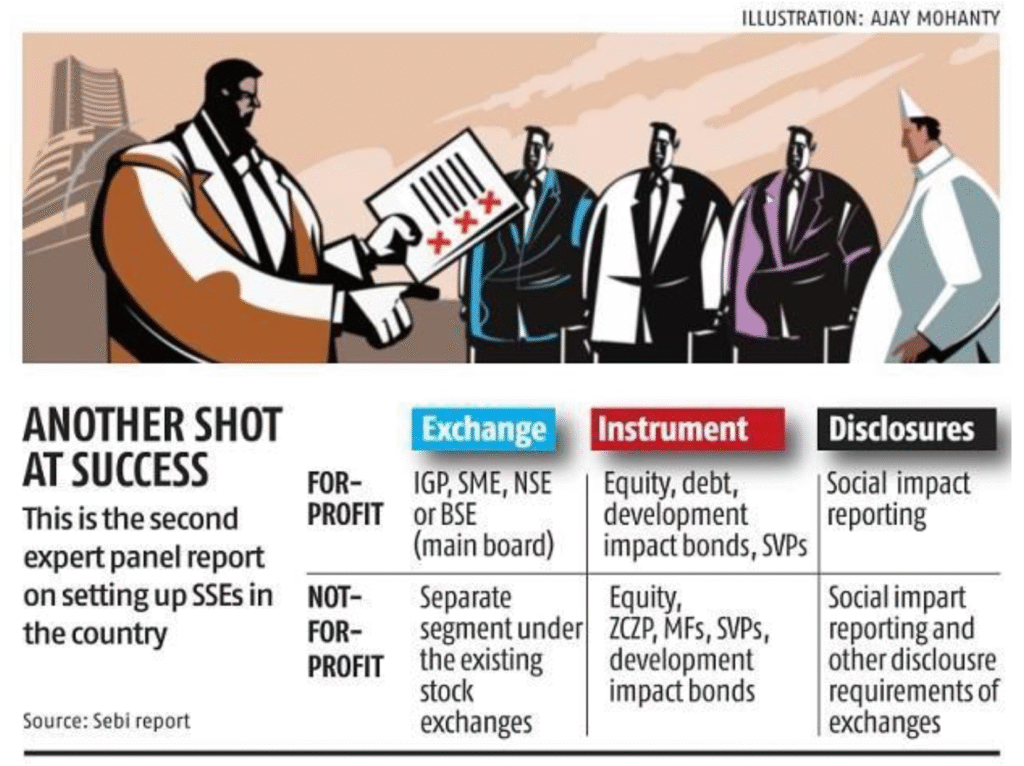

The Union Finance Minister in her Union Budget speech of 2019-20, had proposed creation of a SSE, under the regulatory ambit of SEBI for listing social enterprises and voluntary organizations working for the realization of a social welfare objective, so that they can raise capital as equity, debt or as units like a mutual fund (MF). Launched in mid-2023, the SSE is a dedicated platform where non-profits can access capital by tapping into a new pool of investors – those driven by a dual desire for financial returns and positive societal impact.Under this SSE segment, new avenues are attempted for social enterprises to finance social initiatives, provide them visibility and bring in increased transparency in fund mobilisation and utilisation by the enterprises. Any social enterprise, Non-Profit Organization (NPOs) / NGOs, or For-Profit Social Enterprises (FPEs), with their primary social and community development intent can get registered / listed on SSE segment. For eligible NPOs / NGOs, the first step for onboarding starts with the registration on the Social Stock Exchange segment. Post registration, NPOs can initiate the fund mobilisation process by issuance of instruments such as Zero Coupon Zero Principal (ZCZP) via a public issue or private placement. Currently the regulations have prescribed the minimum issue size as ₹1 crore and minimum application size for subscription at ₹2 lakhs for ZCZP issuance. While the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) of India has received final approval from SEBI to launch SSE as a separate segment, the other Stock Exchanges are in the pipeline to enlist the same.

In this completely new fund-raising instrument, Stock Exchanges are and shall be facing and addressing issues of engaging NPOs, build awareness and making them understand the mechanism and benefits from registering and listing on the Social Stock Exchange segment, hand holding Social Enterprises currently at various stages of onboarding on the Exchange.

The SSE’s effectiveness hinges on two key pillars: transparency and impact measurement. Unlike traditional fundraising avenues, the SSE mandates rigorous social impact assessments and reporting frameworks. This is expected to foster trust and credibility, attracting investors who might otherwise shy away from the perceived “risk” of the social sector. Additionally, it is expected for the NGOs to demonstrate the value they create, not just through financials, but through tangible social outcomes.

The North East India’s social and NPO / NGO sector operates in a rugged terrain, both physical and social. Its remote location, riddled with mountains and dense forests, makes reaching isolated communities a logistical nightmare. Coupled with limited infrastructure and connectivity, this remoteness has hindered resource flow and collaboration for long and till date. Scarce funding, with both government and private investors (less than 4 % of CSR funding in NER) hesitant due to perceived instability, further strangling development efforts.Despite lack of one source information, there are 8539 NGOs in NER (Darpan Portal, NITI Ayog), with Assam having the maximum of 3113 NGOs, followed by Manipur at 2862. While the active nature of these is not clear, given the recent new guidelines from FCRA and consequent financial viability of many and eventual many reaching the state of closing down, during and post Covid. According to the FCRA (Home Ministry) site, there are 147 NGOs in NER having FCRA license during 2012 – 2023. A key question is in this mix of active and non- active NGOs, how many shall be willing and can take the SSE route to fund raising, with the existing access and institutional barriers.

In a region wherein information, processes, systems reaches late and with its own difficulties, the exploration and implementation of SSE in the region has its own challenges more than opportunities. The hurdle is sustained engagement and capacity building for the region’s NGOs and social enterprises on SSE as the NGOs may lack the financial and technical resources to comply with SSE listing requirements, such as robust impact measurement and reporting systems. Building this capacity shall take time with targeted support. Measuring and reporting social impact consistently across diverse sectors and organizations remains a challenge. Standardized frameworks and tools are needed to ensure transparency and comparability and the question is how and what levels the region’s NGOs stand on this. The SSE platform shall require sound technology infrastructure to handle transactions, data management, and investor outreach and can be a cost barrier for both the exchange and participating NGO / NPO organizations.

The concept is still nascent, and reaching out to both NGOs in the region, and willing potential investors is no less herculean. Tailoring eligibility criteria to include the lesser number of active NGOs in the region and in each State is crucial to ensure inclusivity and empower grassroots organizations. With already very little fund flowing to the region, how and whether investors will be ready to walk the SSE mode to fund NGOs in the region and what shall be the safeguard mechanism to this. This unless stakeholders find it less important even if the region’s social and development sector moves into obscurity sooner due to drying funds and support.

Developing robust and standardized impact measurement frameworks remains a complex puzzle. A key question is what mechanism and support system shall be made available for region’s organisations to effectively measure and report their impact, essential for attracting investors and maximizing social return on investment. Attracting investors to the SSE requires raising awareness about its purpose and potential. Investors who prioritize financial returns might need education and incentives to embrace impact investing in the NER. Accessing the SSE might be difficult for organizations in NER due to limited connectivity and resources.

Bridging this divide is crucial for wider participation. Despite these challenges, the SSE’s potential is undeniable. It can act as a catalyst, providing the financial lifeblood that young, passionate changemakers need to turn their ideas into sustainable solutions while addressing development challenges in the NER. Imagine a near future where SSE-driven innovative social ventures blossom across NER, from eco-tourism projects in the North East to skill development programs in rural communities. Such a futurepromises a ripple effect of positive change, empowering not just individual NGOs, but entire communities.

The story of the SSE in India is still being written. Its efficacy to propel the social sector will depend on a nuanced understanding of the diverse needs and challenges across the nation and India’s NER, alongside a sustained commitment to building a robust development ecosystem.

Dr Syed S Kazi is Director at Council for Social and Digital Development (CSDD), Guwahati, Assam. He can be reached at syedskazi@gmail.com